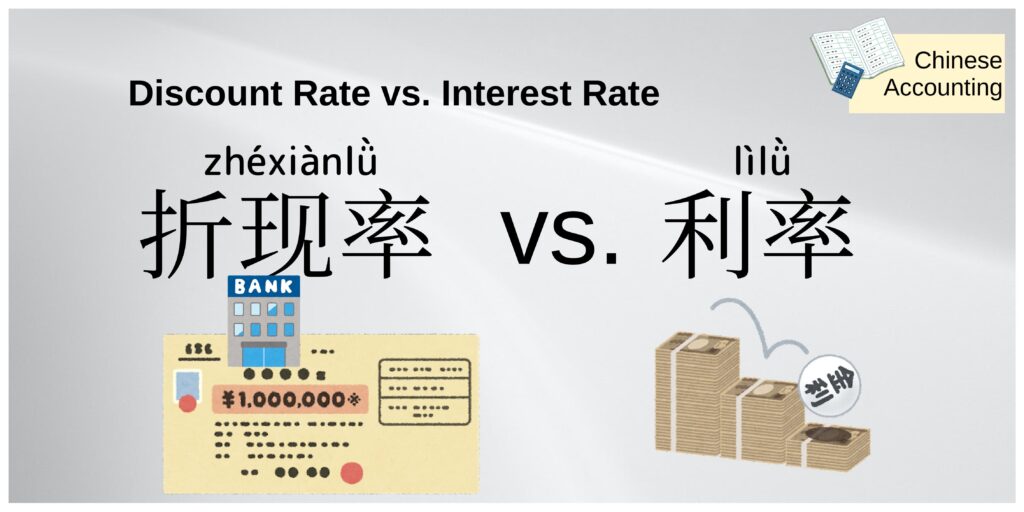

The discount rate (折現率) is considered as a rate of interest, which is used in the calculation of the present value of the future cash inflows or outflows. The concept of the time value of money uses the discount rate to determine the value of certain future cash flows today. If a person called as the lender lends money or some other asset to another person called the borrower, then the former charges some percentage as interest on the amount given to them later. That percentage is called the interest rate (利率).

The discount rate is charged on commercial banks or depository institutions, and the interest rate is on borrowers or individuals.

See the original posts on Facebook, Twitter, Reddit, and Telegram.