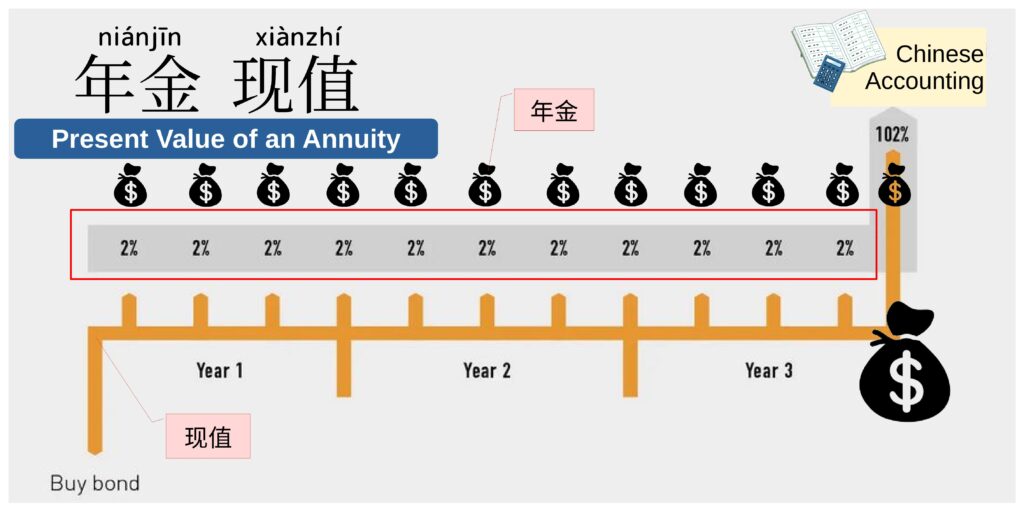

Investors who buy corporate bonds are lending money to the company issuing the bond. In return, the company makes a legal commitment to pay interest on the principal and, in most cases, to return the principal when the bond comes due, or matures.

Because of the time value of money, money received today is worth more than the same amount of money in the future because it can be invested in the meantime.And the present value of an annuity (年金現值) is the current value of future payments from an annuity, given a specified rate of return, or discount rate. The higher the discount rate, the lower the present value of the annuity.

Original posts can be seen on Facebook, Twitter, Telegram, and Reddit.